Social Security Cap 2025 Irs. Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov. Social security and medicare tax for 2025.

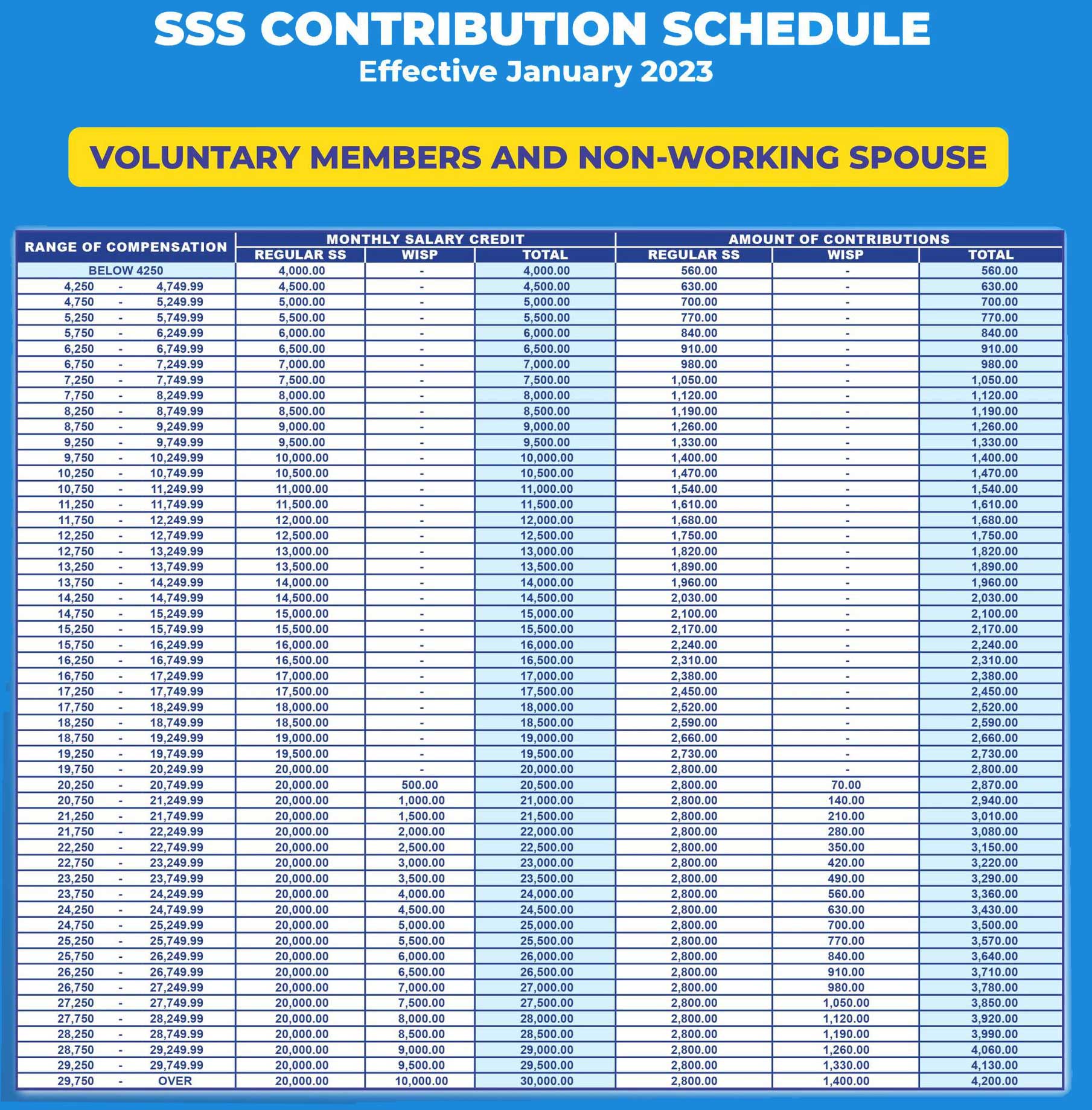

The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. Social security and medicare tax for 2025.

Irs Social Security Cap 2025 Dael Mickie, Retirement limits, tax brackets and more. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Irs Social Security Cap 2025 Dael Mickie, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.

2025 Earnings Limit For Social Security 2025 Myrah Benedicta, (for 2025, the tax limit was $160,200. Social security and medicare tax for 2025.

What'S The Max Social Security Tax For 2025 Carin Cosetta, The latter would kick in. Removing that cap would bring.

Ss Tax Limit 2025 Tiena Gertruda, Social security is financed by a 12.4 percent payroll tax on wages up to the taxable earnings cap, with half (6.2 percent) paid by workers and the other half paid by. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Social Security Tax Cap 2025 Tyne Alethea, The latter would kick in. Most retirees know that social security benefits are adjusted annually to.

Social Security Max 2025 Contribution Lacee Mirilla, The 2025 limit is $168,600, up from $160,200 in 2025. If your social security income is taxable depends on your income from other sources.

Social Security Facts 2025 Image to u, (for 2025, the tax limit was $160,200. The wage base or earnings limit for the 6.2% social security tax rises every year.

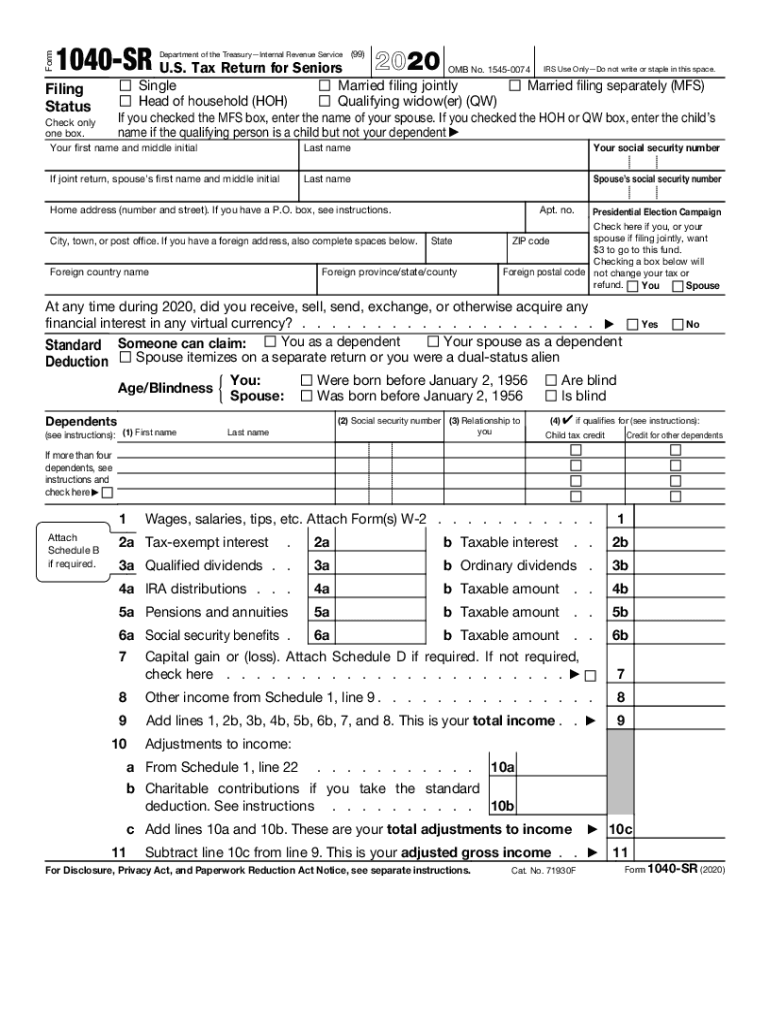

1040 Social Security Worksheet 2025, Social security is financed by a 12.4 percent payroll tax on wages up to the taxable earnings cap, with half (6.2 percent) paid by workers and the other half paid by. We raise this amount yearly to keep pace with increases in average wages.

Social Security And Medicare Rates For 2019 carfare.me 20192020, Workers earning less than this limit pay a 6.2% tax on their earnings. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.